As the market awaits tomorrow’s Bank of Canada interest rate decision, the USD/CAD pair has been rising in anticipation of a rate cut. The pair has also been helped by a sharp drop in oil prices, which have pushed the price down by about 8% from its highs last Wednesday (today it is above $76.40).

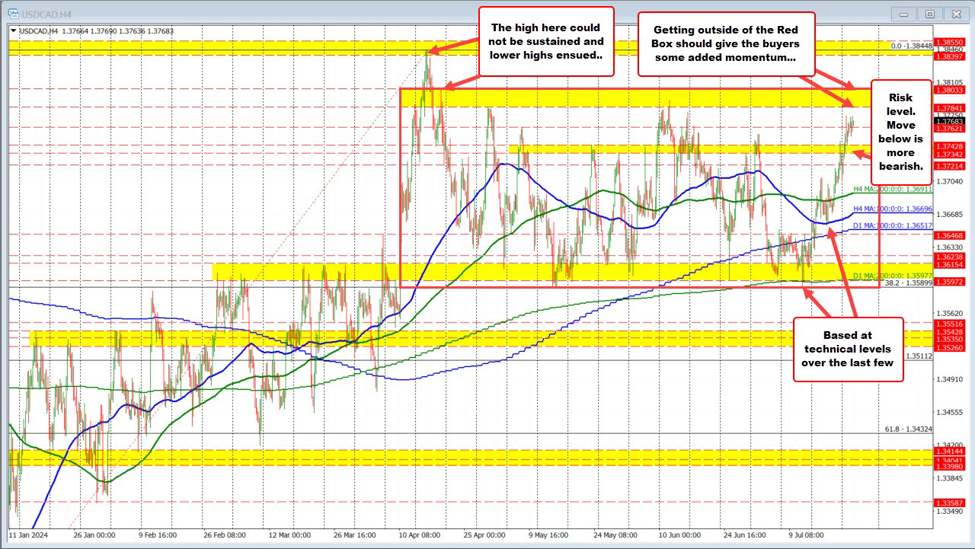

Technically, the USD/CAD pair has been trending higher since hitting lows two weeks ago near the 200-day moving average and 38.2% of the move up from the December 2023 lows. Last week, the price settled near the 100-bar moving average on the 4-hour chart and has been trending higher since that low.

The range high since April is 1.3803. A break above this level would increase the bullish momentum and launch towards the 2024 high at 1.38448.

What might disappoint buyers?

A return below 1.3734 would be a bearish technical breakout. Below that, traders will look to the 200-bar moving average on the 4-hour chart at 1.3691.

The post BOC rate decision and lower oil price help to push USDCAD higher. Technicals more bullish. first appeared on Investorempires.com.