Category: week

-

Markets in a more pensive mood going into the final stretch of the week

•

I will continue to hold that in the bond market for the most part. 10-year Treasury yields are holding at the 200-day moving average, which is now expected to be close to 4.37%. The lowest level reached 4.31% yesterday during the delivery process from Asia to Europe. Daily chart of…

-

Initial jobless claims dip to 222,000 last week, but still above estimates By Investing.com

•

Investing.com – The number of Americans filing for unemployment benefits for the first time was higher than expected last week, although the number was down from the previous period. In the United States it fell to 222,000 in the week ending May 11, down from an upwardly revised total of…

-

US data in the spotlight this week

•

This is one of my favorite strips over the years. It is still of great importance. As we look forward to the new week, it is all about the US data that will move the mood in the broader markets. We already got a teaser last week of a few…

-

Week Ahead in FX (May 13 – 17): U.S. Inflation Plus U.K. And Australia’s Jobs Reports

•

The US Dollar is in for another busy week as Uncle Sam publishes the latest inflation reports! Meanwhile, labor market updates from the UK and Australia are expected to increase volatility for the British pound and Australian dollar. We’ve got a diary on this week’s most watched data releases! Before…

-

Top cryptocurrencies to watch this week: ETH, BOME, HNT

•

Last week, volatility in the cryptocurrency market led to a staggering $100 billion loss. This decline was reflected in the global cryptocurrency market capitalization, which fell by 4% to $2.36 trillion at the time of writing. Here are the top cryptocurrencies to watch over the next few days. Ethereum It…

-

Newsquawk Week Ahead: Highlights include US CPI, US Retail Sales, UK and Australian Jobs

•

Next week May 13-17: He sat down: Chinese inflation (April) Monday: Eurogroup meeting, New Zealand inflation expectations (Q2) Tuesday: OPEC monthly report, German final CPI (April), UK jobs report (April/March), German ZEW survey (May), US PPI (April) married: People’s Bank of China (PBoC) Multilateral, Riksbank Minutes, IEA OMR, Australian Wage…

-

Dollar calm at end of week; sterling gains on growth data By Investing.com

•

Investing.com – The US dollar steadied on Friday after losing ground in the previous session on weak jobs data, while the British pound rose in the wake of stronger-than-expected growth numbers. At 04:10 ET (08:10 GMT), the dollar index, which tracks the US currency against a basket of six other…

-

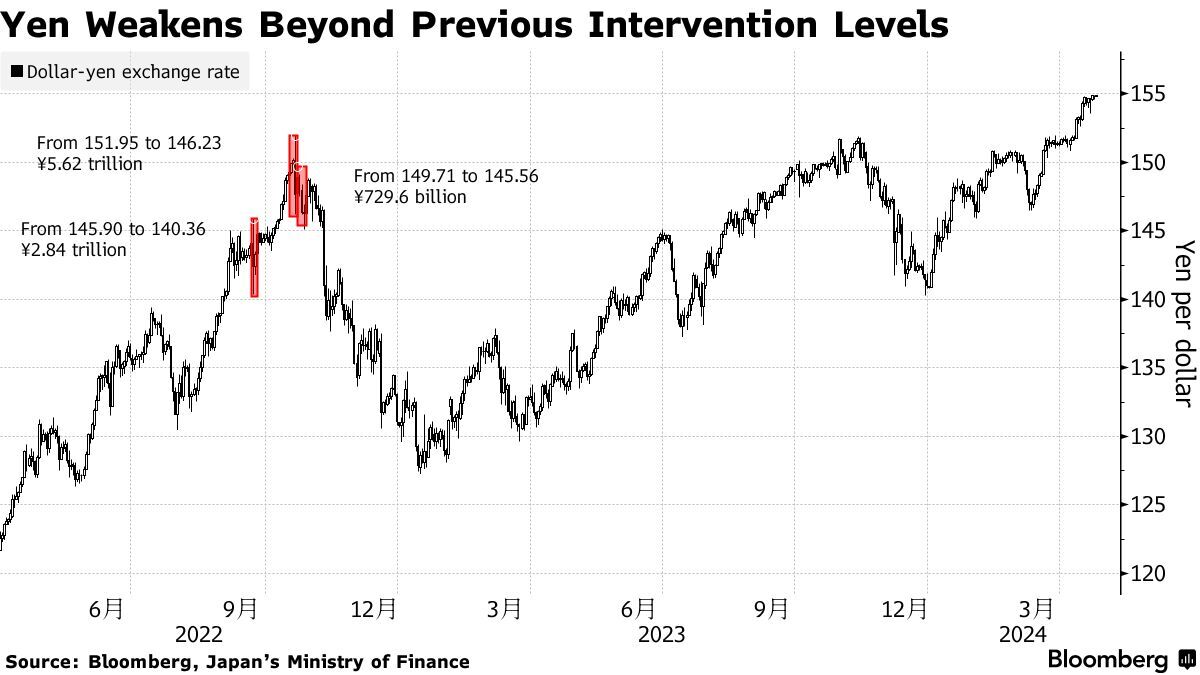

USD/JPY settles below 156 amid a modest recovery this week, what’s next?

•

USD/JPY daily chart The pair has seen a very strong recovery this week, with dip buyers showing some courage. Japan intervened in trading last week to pull the pair down to 152.00, helped by some weak US data. But since then, one-way traffic this week has been on the rise…

-

Forexlive Americas FX news wrap 6 May: US stocks extend gains from last week. USD mixed.

•

It was a quiet day on the economic events front with only April ’employment trends’ on the economic calendar. This index fell to its lowest level since May 2021, but the market largely ignored it. There were two Fed officials speaking. President of the Federal Reserve Bank of Richmond Barkin…

-

Dollar soft on renewed rate cut bets; yen starts week on back foot By Reuters

•

By Samuel Indyk and Ankur Banerjee LONDON (Reuters) – The dollar fell slightly on Monday as a weak U.S. jobs report boosted bets that the Federal Reserve may cut interest rates this year, while the yen fell after suspected intervention last week sparked a wave of volatility. Last week, the…

-

Bitcoin falls to 50% of 2024 range this week and bounces. Price back above 100 day MA

•

The price of Bitcoin fell earlier this week and in the process fell below the 100-day moving average (the blue line in the chart below is currently near $60,000), and towards the mid-50% of the 2024 trading range. At $56,150. This week’s low hit $56,500 (close enough). The subsequent move…

-

Newsquawk Week Ahead: Highlights include RBA, BoE, BoJ SOO, Canada Jobs, UK GDP

•

Mon: UK Bank Holiday; EZ Final Composite & Services PMIs (Apr), Sentix (May) Producer Prices (Mar). Tue: RBA Announcement, EIA STEO; Swiss Unemployment (Apr), German Trade Balance (Mar), EZ Construction PMI (Apr). Wed: Norges Bank H1 Financial Stability Report, Riksbank Announcement, BCB Announcement; German Industrial Output (Mar), Italian Retail Sales…

-

Major US indices close higher for the day and the week

•

The three major US stock indexes closed higher today and this week. The Nasdaq led gains on both measures. Today’s summary shows: The Dow Jones Industrial Average rose 450.02 points, or 1.18%, to 38,675.69 points. The Standard & Poor’s index rose 63.61 points, or 1.26%, to 5,127.80 points. The Nasdaq…